Tungsten production in China

Tungsten is listed as a strategic metal in China and is also one of China’s dominant mineral resources in the world because China accounts for 55% of the world’s tungsten reserves; moreover, China accounted for ~82% of the total world tungsten production in 2020, followed by Vietnam (~5%), Russia (~2.5%), and United Mongolia (~2%). China’s tungsten reserves, production and export volume all rank first in the world, so China plays an important role in the international tungsten market.

1 Tungsten reserves and resources

According to the official data, by the end of 2018, China’s potential tungsten resources were 29.70 Mt (WO3), and the detection rate of tungsten resources was 25.70%. With ongoing exploration work, China’s proven tungsten reserves (WO3) reached 11.204 Mt in 2019. Tungsten deposits in China are mainly distributed in the Nanling metallogenic belt, southeastern coastal metallogenic belt and Qinling metallogenic belt. Therefore, Hunan, Jiangxi and Henan are rich in tungsten resources. The remaining

tungsten reserves in the three provinces account for 66.7% of China’s reserves, and the potential tungsten reserves account for 49.7% of China’s reserves. Based on the generic types of tungsten deposits, coupled with orebody structure, ore composition, and surrounding rock properties, tungsten deposits in China can be roughly divided

into the following four categories: quartz vein wolframite deposits, skarn scheelite deposits, porphyry tungsten deposits, and strata-bound tungsten deposits.

2 Tungsten concentrate production

In China, most of the tungsten ore is mined underground. For the period from 1990 to 2004, the tungsten grades in both underground mining and beneficiation increased significantly; for example, the grades in underground mining and beneficiation were 0.20% and 0.26% in 1990, respectively, but 0.44% and 0.42% in 2004, respectively. Thereafter, tungsten grades in mining and beneficiation decreased and remained at approximately 0.3%. Before 2007, the recovery of tungsten in beneficiation was approximately 80.5%, but thereafter, it declined to approximately 73.7%. This is related to the large-scale recycling of scheelite after 2007. Since the beneficiation technology of scheelite is not as mature as that of wolframite and the occurrence state of scheelite in nature is more complicated, the recovery and utilization of scheelite are more difficult.

To ensure the advantage of tungsten resources, the minimum value of mining recovery and beneficiation recovery and the comprehensive utilization ratio of tungsten mineral resources in China are required according to the current technology level of tungsten mining.

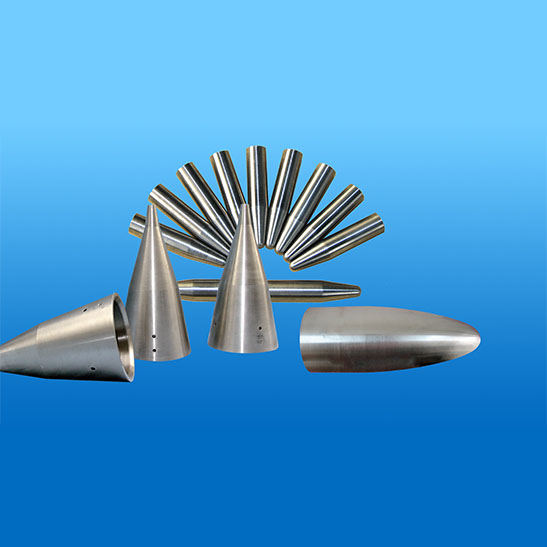

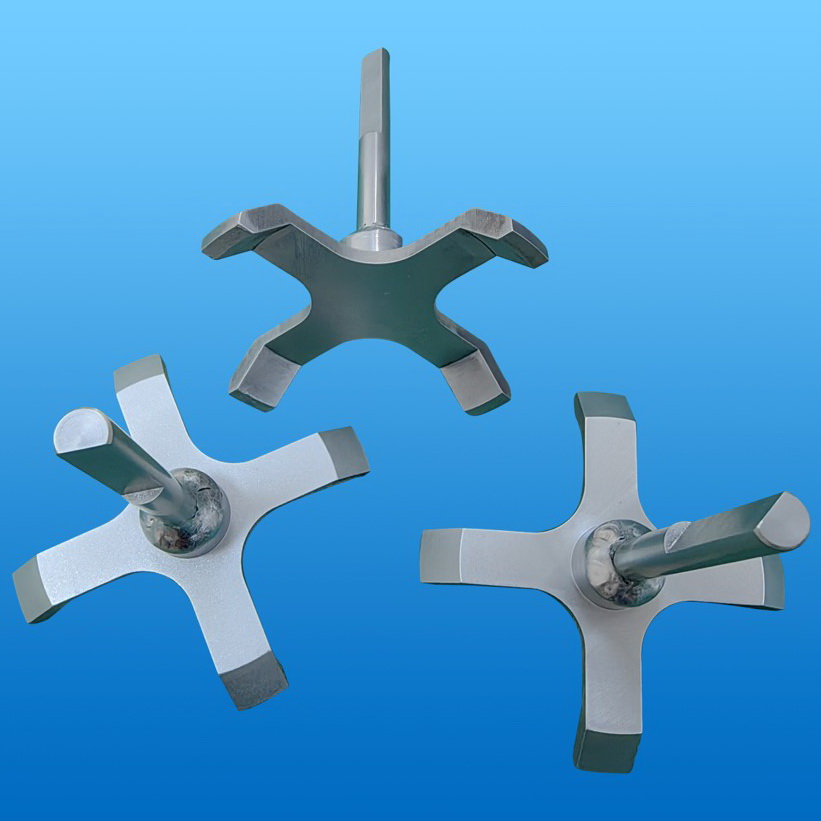

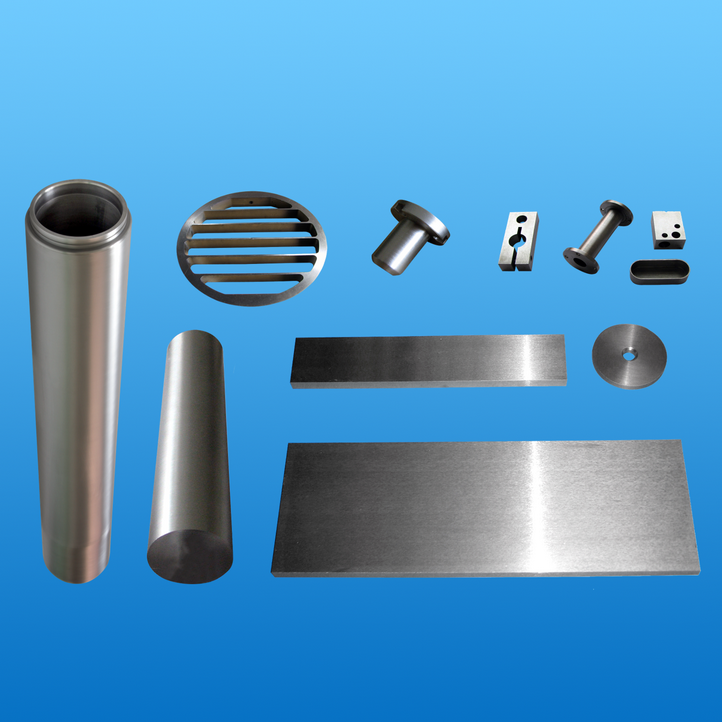

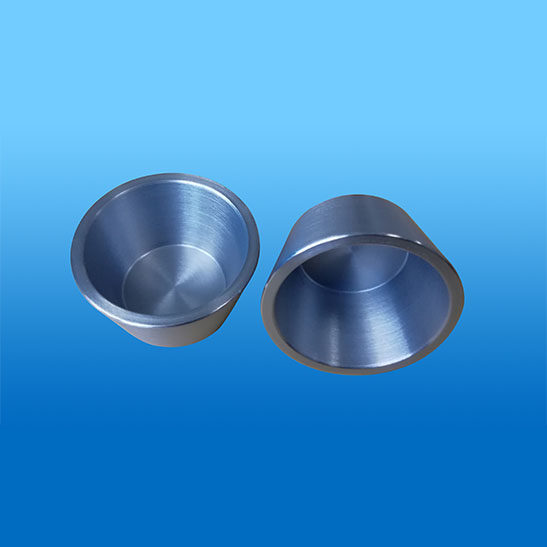

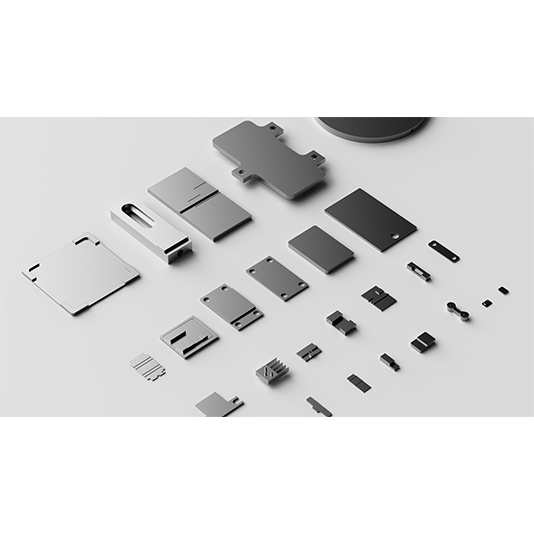

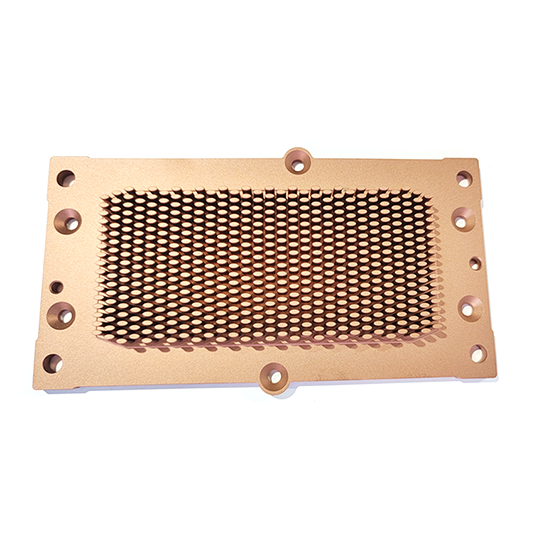

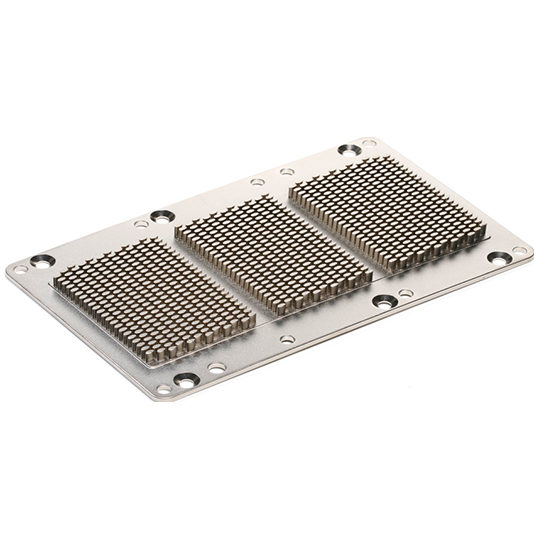

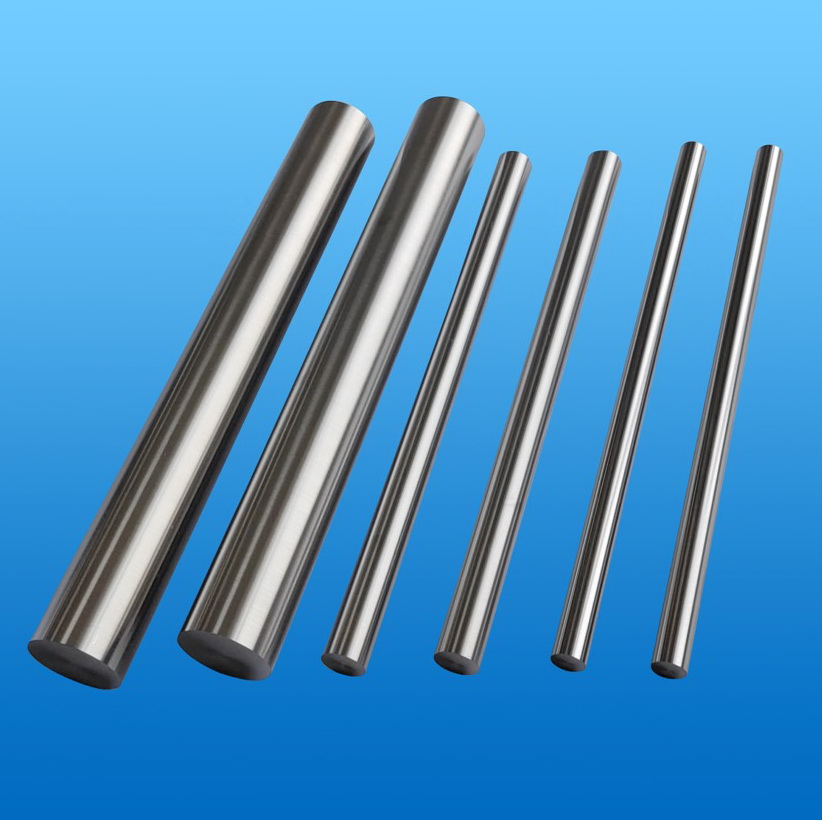

Production has significantly increased since 2000, reaching 92.03 kt in 2016. The end-use of tungsten was distributed as follows: cemented carbides (46.4%), especialty

materials (22.4%), steels and (25.6%), chemicals tungsten (5.7%) . Nearly half of the tungsten was used in cemented carbide parts for cutting and wear-resistant

applications, primarily in the construction, metalworking, mining, and oil and gas drilling industries. Thus, tungsten is indispensable in economic and social development.

3 Expected future tungsten concentrate production

The future output of tungsten in concentrate was evaluated by linear regression analysis based on GDP/capita, which in turn was calculated based on the GDP projections. The historical Chinese population and GDP data were taken from National Bureau of Statistics of the People’s Republic of China and World Bank, respectively. From 2017 to 2019, China’s GDP grew at annual rates of 6.95%, 6.75% and 5.95%, respectively. Due to the impact of COVID-19, China’s GDP growth rate in 2020 was only 2.30%. However, it is expected that by 2021, China will have shaken off the negative impact of the epidemic, and the annual GDP growth rate will return to the pre-epidemic level;

therefore, five scenarios in the period from 2021 to 2035 for China were studied, with five potential annual GDP growth rates (5.5%, 6.0%, 6.5%, 7.0%, and 7.5%). China’s population in the period from 2021 to 2035 has been forecast (medium variant) by the United Nations.

The results of statistical analysis have shown that the Pearson’s correlation coefficient (r) between GDP/capita and the output of tungsten in concentrate in China is 0.94119. Thus, the linear regression analysis was conducted using the historical production of tungsten in concentrate and GDP/capita. Under these five scenarios with different annual GDP growth rates, the mine production of tungsten (WO3) in concentrate in China by 2025 was estimated to be 128−139 kt. The growth rate of this production in 2025 compared with that in 2015 was calculated to be 58%−65%. By 2035, the production of tungsten (WO3) in concentrate was estimated to be 203−262 kt, and this growth rate, compared with the production in 2015, was calculated to be 141%−212%. At the end of 2015, the tungsten reserves (WO3) and identified tungsten resources (WO3) were estimated to be 2331 kt and 9558 kt, respectively. Based on the prediction, China’s current tungsten reserves will be exhausted by approximately 2032. However, with progress in the mineral processing technology or a rise in metal prices, today’s identified tungsten resources can also become future tungsten reserves.